Where CROs and risk leaders confront volatility, regulation, and transformation

Attendees

CROs & Senior Leaders

Speakers

Join us in Sydney to explore the latest in risk management, compliance and complex finance

Risk Live Australia provides risk management, technology & data and trading professionals with the information required to cope with regulatory and economic changes in the Australian market, and an opportunity to share best practice approaches to the most pertinent industry challenges.

We'll be in Sydney on August 5 to focus on the cutting-edge of risk management, regulation, trading, and technology for buy and sell-side firms.

Earlier that week on August 3, we'll be in Melbourne for a series of Leaders' Network roundtable discussions, predominantly for senior buy-side professionals.

Attending organisations include

Testimonials

Fantastic event. The CRO discussion was particularly insightful.

I really enjoyed some of the panels where there was seniority and different perspectives - e.g. conduct panel was fabulous, as well as the derivatives session.

The speakers were outstanding - brought a macro perspective to the issues that we face as risk professionals on a daily basis.

What's new for 2026?

Risk Live Australia deepens its focus on how financial institutions are adapting risk frameworks amid regulatory change, technological disruption and evolving market structures. The 2026 programme introduces more targeted discussions, practitioner-led sessions and peer benchmarking — helping leaders translate complexity into practical action.

Interested to speak at Risk Live Australia? Enquire today.

Big-picture themes for 2026

- Regulatory Change & Compliance: Direct exposure to institutions navigating APRA CPS230 and evolving operational resilience requirements — plus broader regulatory shifts impacting governance, risk frameworks and compliance strategy.

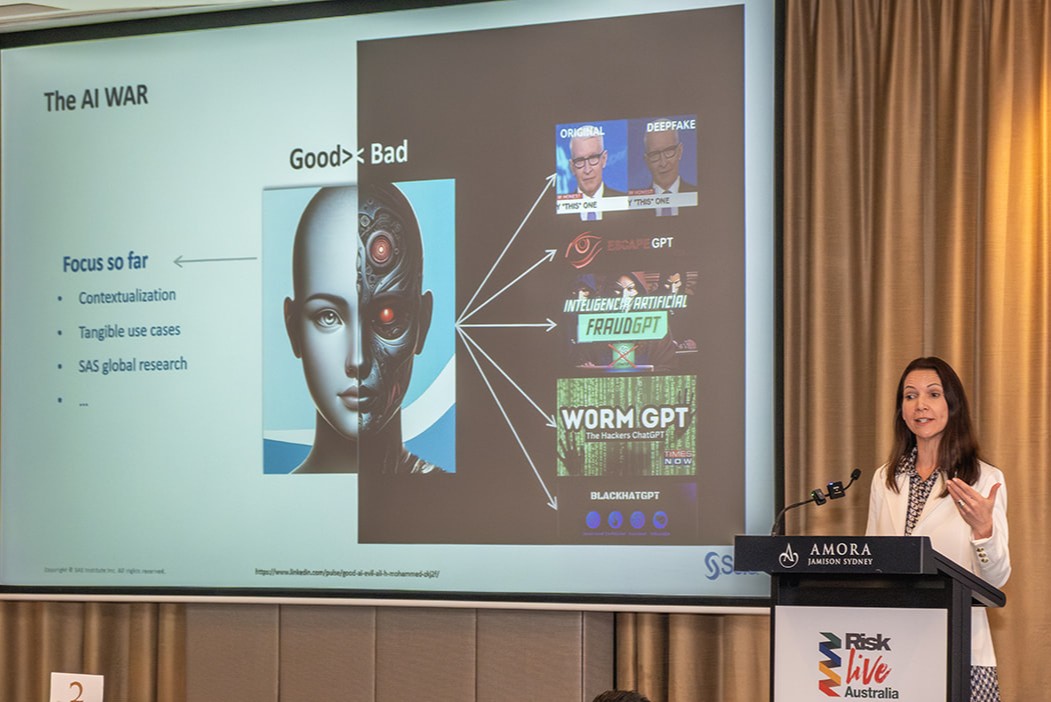

- Technology, Data & AI: Connect with leaders exploring how AI/ML, data governance and modern platforms are transforming risk management, modelling and decision-making.

- Cyber, Fraud & Operational Risk: Engage with banks and financial institutions tackling rising fraud, cyber threats and operational resilience challenges in an increasingly digital ecosystem.

- Market & Economic Context: Visibility with risk leaders managing volatility, interest rate exposure and macro uncertainty as they recalibrate portfolios and stress frameworks for 2026-27.

Curated for Risk Management professionals

Delivered by Risk.net

Risk Live Australia will bring our market-leading editorial content and research to life in Australia. The conferences unite senior professionals responsible for risk management and traded risk to provide exclusive insights and form meaningful business connections.

Explore Risk.net's market-leading insights here and enquire to learn more about individual and group subscription rates.

Sponsors

SAS

Behavox

Smartstream

Contact the team

Find out more information about speaking, sponsorship, or delegate enquiries.